Ashfords have recently decided to move to a streamlined easy-to-use electronic signing platform via FuseSign, and a new ATO client

mail system called ATO SmartDocs. One of our highest priorities is getting documentation out to our clients as quickly and securely as

possible and with FuseSign and ATO SmartDocs we can achieve both of these while providing you with the best experience possible.

What is ATO SmartDocs?

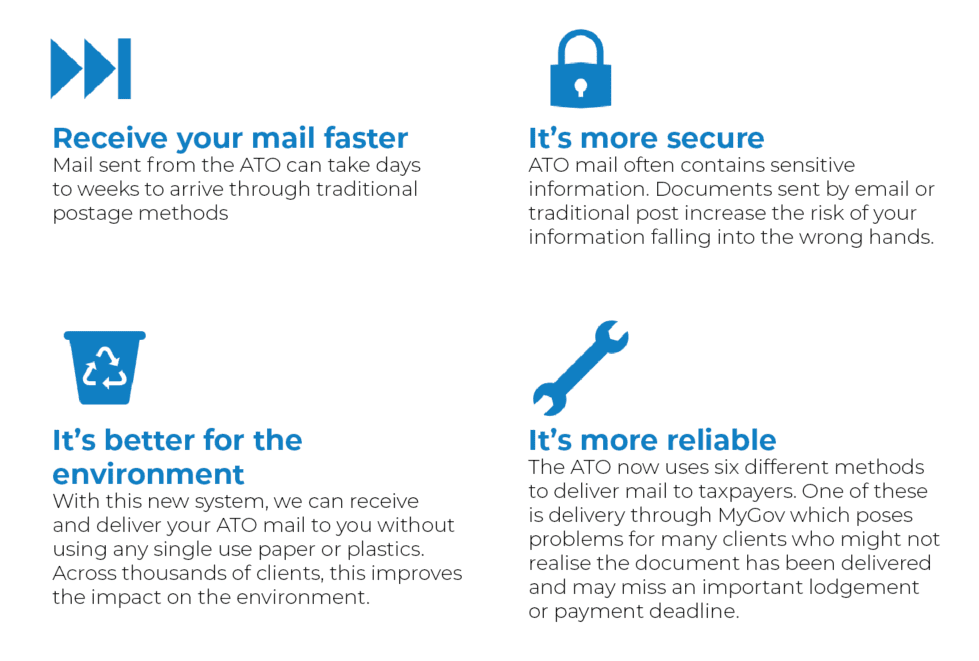

ATO SmartDocs is a convenient mail service that enables us to download all ATO mail on behalf of our clients and distribute it

efficiently.

Some of the benefits of this service is as follows:

FuseSign: What does this mean for you?

Within FuseSign we have set you up with your contact details including your mobile number. Mobile numbers are important in the FuseSign

process as this acts as your authenticator when signing your documentation.

Once we have prepared your document bundle within the new platform there are a few simple steps to review and sign. Follow the steps

or watch this short video to be guided through

https://vimeo.com/439139011

- Firstly you’ll receive a document bundle link via an Email. This will come from a FuseSign email address on behalf our office.

- In the body of the email there will be a link to open your secure document bundle.

- You will then be presented with an online view of your documents to review and digitally sign.

-

Click the Sign Document Button and to validate you are signing the documents you will receive a personal SMS verification code to your

mobile number for you to enter.

-

Now that your documents have been authorised and signed you will receive an automated email as soon as all parties have finalised their

signing actions in the bundle.

Going forward we see Digital Signing via FuseSign as a quick and simple way to deliver and have you approve and sign documents. We are

still very happy to sit down with you to sign your documentation or post your documentation if that is what you would prefer.

Going forward we see Digital Signing via FuseSign as a quick and simple way to deliver and have you approve and sign documents. We are

still very happy to sit down with you to sign your documentation or post your documentation if that is what you would prefer.

Please note that in the initial stages of your use of FuseSign, emails may be directed to your junk or spam folder. This issue should

resolve itself through your continued use of the software, as your mail client will recognise the sender as a trusted contact.

If at any time you are unsure how to proceed with signing your document bundle, have any questions about the information you’ve supplied

please call our office and we’ll more than happy to assist.

Going forward we see Digital Signing via FuseSign as a quick and simple way to deliver and have you approve and sign documents. We are

still very happy to sit down with you to sign your documentation or post your documentation if that is what you would prefer.

Going forward we see Digital Signing via FuseSign as a quick and simple way to deliver and have you approve and sign documents. We are

still very happy to sit down with you to sign your documentation or post your documentation if that is what you would prefer.