For households and businesses alike, cash flow—the net movement of money over a given timeframe—is one of the most important financial

metrics to track. Quite simply, it is imperative to understand the various drivers of cash flow. Maintaining a healthy cash flow ensures a

household or business can remain financially operational over the long-term.

Despite its obvious importance, however, poor cash flow management continues to be as common as ever. This is particularly true for small-

and medium-sized businesses (SMEs), where cash flow-related issues are frequently the cause of their closure. So frequent, in fact, that a

U.S. Bank study found that 82 percent of small businesses fail due to cash flow mismanagement and an inadequate understanding of cash

flow.

Not measured, not managed

In an age where sales growth and profitability targets are discussed in meeting rooms ad nauseum, the focus on cash flow has become

minimal at best for many business owners. Whilst it is not necessarily wrong to focus on these areas of business performance, doing so at

the expense of committing resources to cash flow management can prove detrimental.

This often hits home for business owners when—despite having seen encouraging growth in various sales and profitability metrics—they find

are struggling more than ever to generate enough money to cover expenses like payroll, loan payments, and taxes. Indeed, the expression

“cash is king” didn’t become popular for no reason.

Why cash flow management matters, and help your business

Whereas cash flow is the term used to describe net changes in an entity’s cash balance between any two points in time, cash flow management

relates to the way these changes are monitored and analysed.

Devoting resources to cash flow management helps to ensure that trends are detected—and thus, dealt with—earlier than they otherwise would.

Spending more time on cash flow management can also help improve a business’ ability to plan for the future.

Understanding a business’ historical cash flow performance is vital in the context of both short- and long-term budgeting. Estimated cash

reserves, for example, will prove far more reliable, bolstering the extent to which a budget can serve its purpose as a point of reference

for a business owner throughout the financial year.

Similarly, in a scenario where positive cash flow has been progressively upward trending—and, hence, a business owner is considering

expansion—knowing the context behind this continued cash flow growth will make for a far more informed decision-making process in relation

to a possible expansion. Can the business take on more staff? Enter into another vertical? Open another store? Businesses with a history of

sound cash flow management are able to answer these questions resolutely.

Cash flow management solutions

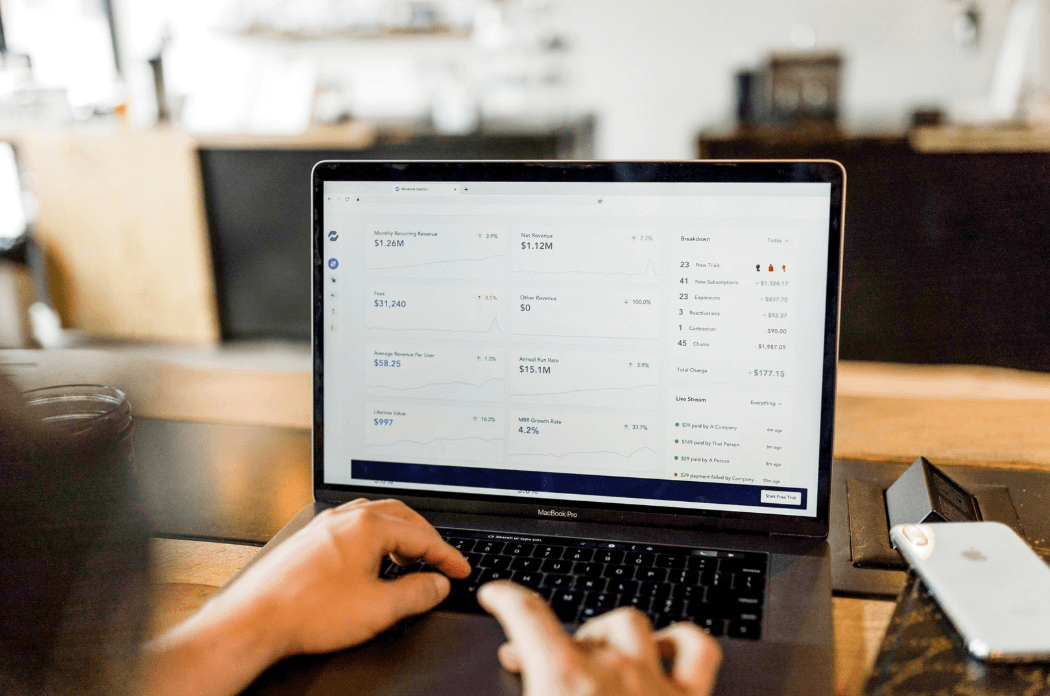

Fortunately for business owners, it has never been easier to analyse, manage, and understand their business’ cash flows. As a Platinum

Champion Partner

of Xero’s cloud-based accounting software platform, Ashfords’ accountants and business advisors are highly familiar with the latest cash

flow management applications that are available to budget and forecast your cash flows.

Two Xero-integrated apps that Ashfords’ clients find particularly handy are Futrli

and Spotlight

Reporting.

Designed to make monitoring key metrics like cash flow as user-friendly as possible, Futrli and Spotlight Reporting are two of the Xero

App Marketplace’s

go-to solutions for business owners looking to gain a comprehensive understanding of their business’ cash flow performance.

The best thing about Futrli and Spotlight Reporting, is that they connect straight to your Xero file, making the process of turning your

figures into meaningful data, virtually seamless. If this is of interest to you, just get in touch with your trusted advisor and they will

be able to get you set up in no time!